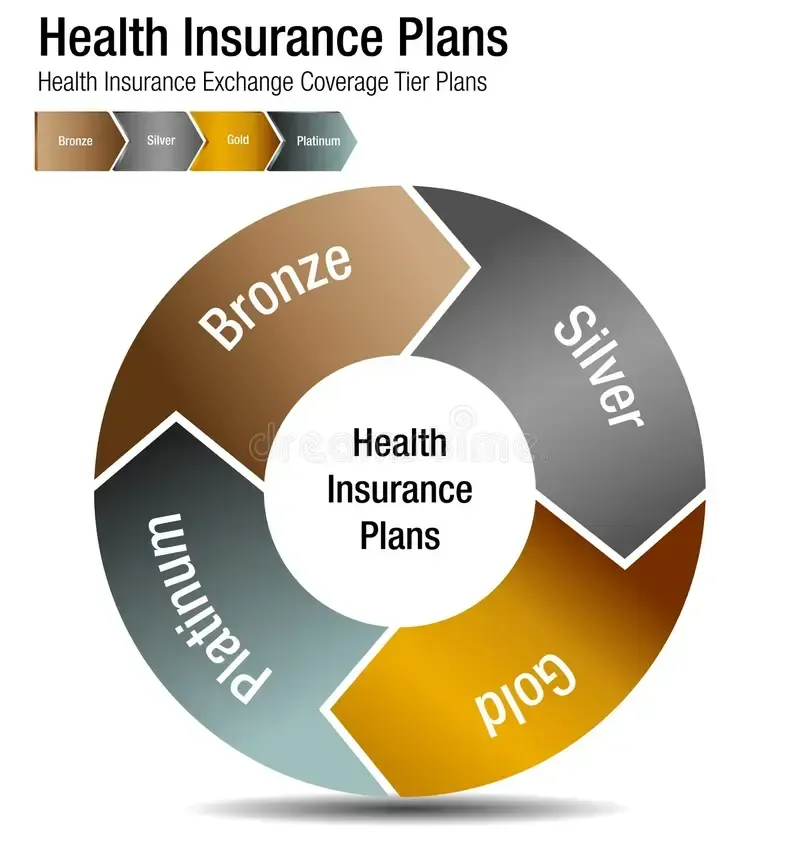

Understanding Metallic Health Plans: What Bronze, Silver, Gold & Platinum Really Mean

If you’ve ever shopped for health insurance on the Marketplace, you’ve likely seen plans labeled Bronze, Silver, Gold, and Platinum. These are known as the metallic tiers, and while the names might sound like they describe quality, they actually represent how you and the insurance company split costs—not how good the coverage is.

At Moen Insurance Services, we help individuals, families, and small businesses across North Dakota understand their options and choose the coverage that fits their budget and needs. Here’s a clear breakdown of what the metal levels really mean and how to decide which one is right for you.

🥉 Bronze Plans: Lowest Monthly Premiums, Highest Deductibles

Bronze plans are designed for people who want affordable monthly premiums and don’t expect to use many medical services throughout the year.

Key features of Bronze plans:

- Lowest monthly cost

- Highest deductibles and out-of-pocket expenses

- Typically cover about 60% of medical costs

- Great for younger or healthier individuals who mainly want protection against major medical events

If you just need something in place “in case something big happens,” Bronze may be a fit.

🥈 Silver Plans: Middle-Ground Coverage With Big Savings Potential

Silver plans sit right in the middle when it comes to monthly premiums and deductibles. But they come with one major benefit: Cost-Sharing Reductions (CSR).

This is the only metal level where CSR discounts apply, and these discounts can dramatically lower deductibles, copays, and out-of-pocket maximums for households that qualify.

Silver plans typically offer:

- Moderate premiums

- Moderate deductibles

- About 70% of medical costs covered

- Potential for enhanced coverage with CSR, making your plan feel more like Gold or Platinum

For many North Dakota families, a Silver plan with CSR often ends up being the best value on the Marketplace.

🥇 Gold Plans: Higher Premiums, Lower Upfront Costs

Gold plans are built for people who use health care more regularly—those who want predictable costs and lower deductibles.

What Gold plans offer:

- Higher monthly premiums

- Lower deductibles and out-of-pocket costs

- Roughly 80% of costs covered

- Good for people with ongoing medical needs or multiple prescriptions

If you prefer stability and fewer surprises when you visit the doctor, Gold is usually the sweet spot.

💎 Platinum Plans: Maximum Coverage for High Medical Use

Platinum plans are the highest tier and the least common on the Marketplace. They offer the lowest out-of-pocket costs but come with the highest monthly premiums.

These plans generally include:

- Highest monthly cost

- Very low deductibles

- About 90% of costs covered

- Ideal for people who know they’ll use a lot of medical services throughout the year

If you have significant ongoing care needs, a Platinum plan can save you money overall despite the higher premium.

🔍 Important Note: Metal Levels Do Not Affect Provider Networks

Whether you choose Bronze or Platinum, the

doctors you can see and hospitals you can visit stay the same.

Metal tiers only affect

how costs are shared, not the quality of care or the network of providers.

🧭 Which Plan Is Right for You?

Choosing the right plan depends on:

- Your monthly budget

- How often you use health care

- Whether you qualify for tax credits or CSR

- Your prescriptions and medical history

- Your household size and income

As your local North Dakota insurance agency, Moen Insurance Services can walk you through your options, calculate your subsidies, and help you choose a plan that fits you—not just your budget, but your lifestyle.

📞 Need Help Picking the Best Plan? We're Here for You.

Shopping health insurance doesn’t have to be confusing. If you want expert help comparing Bronze, Silver, Gold, and Platinum plans—or you just want to make sure you’re not overpaying—reach out anytime.

Moen Insurance Services, LLC

Local Agents. Local Service.

Serving Grand Forks, Thompson, Lakota, and surrounding North Dakota communities.