This is a subtitle for your new post

What Medicare Plan Is Right for Me? (North Dakota Edition)

Choosing a Medicare plan can feel like a big decision — and it is! With several plan types, coverage levels, and costs to compare, it’s easy to feel unsure about what’s right for you. But if you live in North Dakota, there are some local factors that can help narrow it down.

Let’s walk through the basics so you can feel confident about your Medicare choices.

Step 1: Start With Original Medicare (Parts A & B)

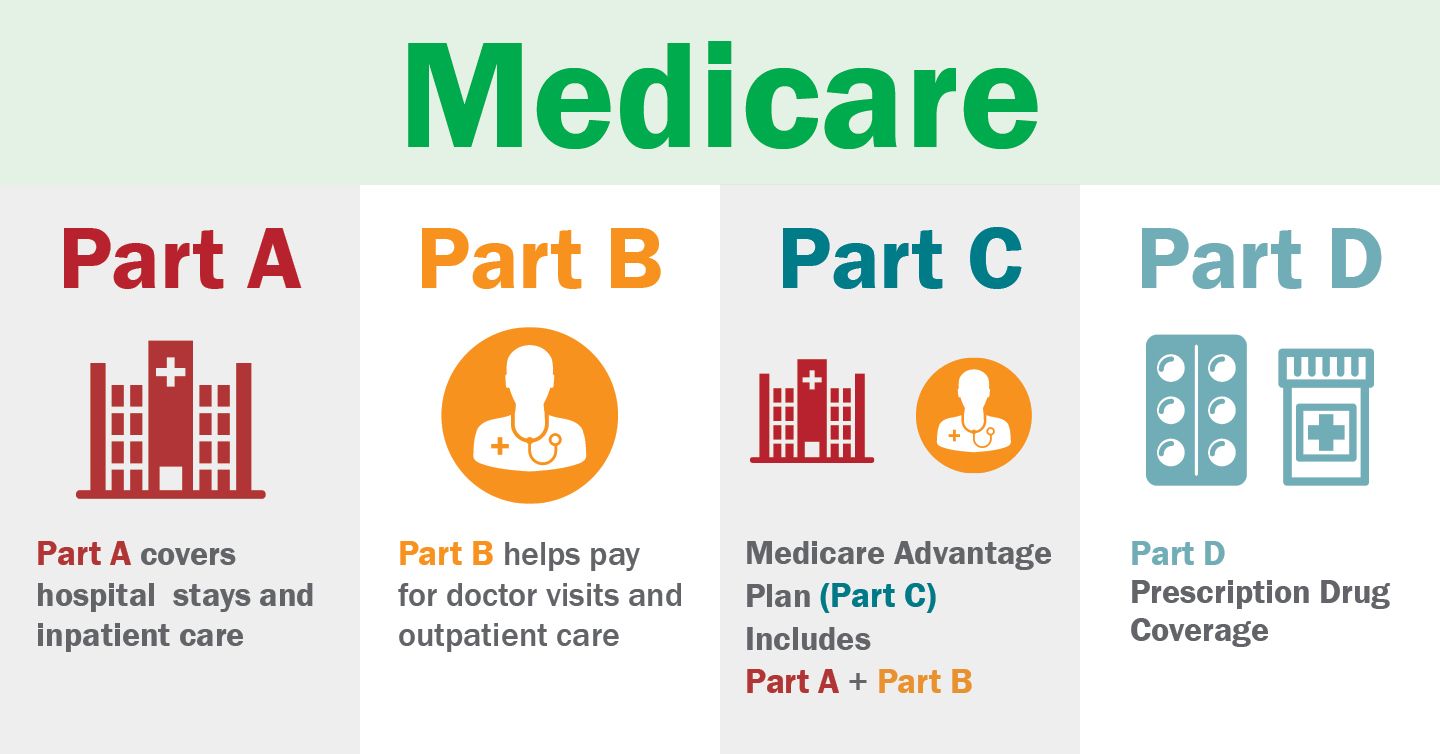

Most North Dakotans begin with Original Medicare, which includes:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing care, and some home health services.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, preventive services, and durable medical equipment.

Original Medicare provides solid coverage, but it doesn’t cover everything — like most prescription drugs, dental, vision, or hearing. That’s why many people add additional coverage.

Step 2: Add Prescription Coverage (Part D)

If you take medications, you’ll likely want a Part D prescription drug plan.

In North Dakota, Part D plans are offered by several private insurance companies. Costs and covered medications vary, so it’s important to compare plans based on your prescriptions and preferred pharmacy — especially if you live in a smaller town or rural area where pharmacy options are limited.

Step 3: Decide Between a Medicare Supplement (Medigap) or Medicare Advantage Plan (Part C)

This is where many people have questions — and for good reason.

Medicare Supplement (Medigap):

- Works with Original Medicare.

- Helps cover out-of-pocket costs like deductibles and copays.

- You can see any doctor or hospital that accepts Medicare, anywhere in the U.S.

- You’ll need a separate Part D plan for prescriptions.

✅ Best for: North Dakotans who travel, spend winters down south, or live in rural areas where provider choice matters.

Medicare Advantage (Part C):

- Combines Parts A, B, and usually D into one plan.

- Often includes extra benefits like dental, vision, hearing, and gym memberships.

- Usually has a network of providers, which may be limited in rural parts of North Dakota.

✅ Best for: People who prefer an “all-in-one” plan with lower monthly premiums and access to extra benefits — and who live near larger cities like Fargo, Grand Forks, or Bismarck, where networks are stronger.

Step 4: Consider Your Health, Budget, and Lifestyle

When deciding which Medicare plan fits you best, think about:

- 🏡 Where you live: Rural residents may find Medigap more flexible, while urban residents might enjoy the convenience of Medicare Advantage.

- 🚗 How often you travel: If you’re on the road often or head south for the winter, Medigap offers nationwide coverage.

- 💊 Your medications: Compare drug coverage closely — some plans have lower costs for specific pharmacies.

- 💵 Your monthly budget: Medicare Advantage often has lower premiums but higher out-of-pocket costs when you need care. Medigap tends to cost more monthly but limits unexpected bills.

Step 5: Get Local Help

Every person’s situation is unique — and the best Medicare plan for your neighbor might not be right for you. That’s why it’s helpful to work with a local, independent agent who understands North Dakota’s Medicare options.

At Moen Insurance Services, we’re based right here in North Dakota and know which plans are available in your area. We’ll walk you through your options, explain how they work, and help you choose coverage that fits your health, lifestyle, and budget.

Ready to find the right Medicare plan for you?

👉 Contact

Moen Insurance Services today for a personalized Medicare review — simple, local, and tailored to North Dakotans.