Annual Enrollment 2026: What You Need to Know

Annual Enrollment: What You Need to Know

It’s that time of year again — Medicare’s Annual Enrollment Period (AEP) is here! Each fall, Medicare beneficiaries have the opportunity to review, compare, and make changes to their coverage for the upcoming year. Whether you’re already enrolled in Medicare or you’re just starting to explore your options, understanding how AEP works can help you make smart, confident decisions about your healthcare.

What Is the Annual Enrollment Period?

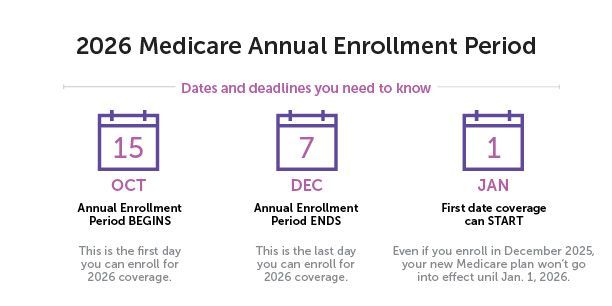

The Annual Enrollment Period runs from October 15 through December 7 each year. During this time, you can:

- Switch from Original Medicare to a Medicare Advantage plan (Part C)

- Switch from a Medicare Advantage plan back to Original Medicare

- Change from one Medicare Advantage plan to another

- Join, switch, or drop a Medicare Part D prescription drug plan

Any changes you make during AEP take effect on January 1 of the following year.

Why Reviewing Your Plan Each Year Matters

Even if you’re happy with your current plan, it’s important to take a few minutes each year to review your coverage. Plans can — and often do — change from year to year. Premiums, copays, covered medications, and provider networks can all shift, and a quick review ensures you’re not caught off guard.

You may also find that your own needs have changed — new prescriptions, a preferred doctor, or different health priorities. Reviewing your options ensures your plan still fits your lifestyle and budget.

Tips for Making the Most of AEP

- Review your Annual Notice of Change (ANOC).

Your insurance company will mail this each fall. It outlines any changes to your plan for the upcoming year. - Compare your options.

Look at premiums, out-of-pocket costs, drug coverage, and provider networks. - Ask questions.

A licensed insurance agent can help you understand the details and find a plan that works best for your situation. - Don’t wait until the last minute.

The deadline is firm — all changes must be submitted by December 7.

Need Help Navigating Your Choices?

Medicare can be confusing, but you don’t have to figure it out alone. At Moen Insurance Services, we specialize in helping North Dakotans understand their Medicare options and find the coverage that fits them best — at no cost to you.

If you’d like a personalized review or have questions about your current plan, contact us today to schedule a free consultation during the Annual Enrollment Period.